12 Ways to Save and Invest Your Money in 2024: Building a Secure Financial Future

By Eric Screven

Managing our finances wisely is essential for achieving long-term financial security and realizing our dreams. As we step into the year 2024, it’s an opportune time to explore new strategies and avenues to save and invest our money effectively. Whether you’re starting your financial journey or looking to enhance your existing financial plans, here are 12 ways to save and invest your money in the year ahead.

1. Create a Budget: Begin by creating a comprehensive budget that outlines your income, expenses, and savings goals. By tracking your spending and adhering to a budget, you can identify areas where you can cut back and allocate more funds toward saving and investing.

2. Build an Emergency Fund: Establish an emergency fund to prepare for unexpected expenses or financial setbacks. Aim to save at least three to six months’ worth of living expenses in a separate account that is easily accessible.

3. Automate Savings: Set up automatic transfers from your paycheck to a designated savings or investment account. By automating your savings, you ensure consistent contributions without the temptation to spend the money elsewhere.

4. Explore High-Yield Savings Accounts: Consider opening a high-yield savings account that offers competitive interest rates. These accounts can help your savings grow faster, providing a solid foundation for your financial future.

5. Diversify Your Investments: Diversification is key to managing risk and maximizing returns. Spread your investments across different asset classes, such as stocks, bonds, real estate, and mutual funds, to protect yourself from market volatility.

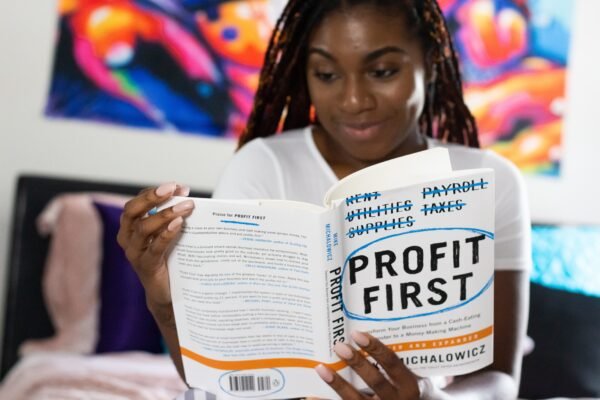

6. Educate Yourself about Investing: Take the time to educate yourself about various investment options and strategies. Attend workshops, read books, or consult with a financial advisor to gain knowledge and make informed investment decisions.

7. Contribute to Retirement Accounts: Maximize your contributions to retirement accounts such as 401(k)s, IRAs, or pension plans. Take advantage of employer matching contributions if available, as these can significantly boost your retirement savings.

8. Consider Index Funds or ETFs: Index funds and exchange-traded funds (ETFs) offer a cost-effective way to invest in a diversified portfolio of stocks or bonds. These passively managed funds can provide steady returns and require less active management.

9. Invest in Real Estate: Explore investment options, such as purchasing rental properties, investment trusts (REITs), or real estate crowdfunding platforms. Real estate can provide both income and potential long-term appreciation.

10. Start a Side Hustle: Consider starting a side business or doing freelance work to generate additional income. The extra money earned can be dedicated to savings or invested to accelerate your financial goals.

11. Stay Informed and Review Investments Regularly: Stay updated on financial news and review your investment portfolio periodically. Keep an eye on market trends and seek professional advice if needed to ensure your investments align with your goals.

12. Prioritize Long-Term Thinking: Maintain a long-term perspective when it comes to your investments. Avoid making impulsive decisions based on short-term market fluctuations. Instead, focus on building a sustainable, diversified portfolio that aligns with your financial objectives.

As we move further into 2024, let us prioritize our financial well-being by implementing these 12 strategies for saving and investing our money. By creating a strong foundation of savings, diversifying our investments, and staying informed about financial opportunities, we can build a secure future and work towards our financial goals. Remember, the key lies in consistent effort, discipline, and a long-term perspective. May this year be a stepping stone towards financial prosperity and greater peace of mind.

Post a comment: